The right capital relationship is not only about dollars funded, but it also needs to be dependable, provide flexibility, and fit a risk management strategy. The risk-return balancing act played out by builders and developers is constantly evolving, and, today, new capital in housing provides more options than ever before.

Through daily interaction with home builders and capital providers, I have insight into the opportunities financing sources provide, and what experienced builders are choosing to do during this current stage of industry growth. For many builders, these choices have become a normal course of business and a way to balance their strategy. Capital availability being significant today allows builders to play bigger than imagined, especially when the right relationship is found. The strategies below mitigate exposure, give builders more flexibility, and allow for expansion.

Land banking provides an off-balance-sheet, low-risk opportunity for home builders to develop their project, as well as acquire finished lots. Land bankers, which are private capital groups, will purchase land on behalf of the builder/developer while providing funding for the horizontal development. Once the builder completes the horizontal work, the builder will purchase the finished lots back from the land banker at a predetermined takedown pace and price. Interest can be paid current or can accrue and roll into the finished lots at takedown. The builder deposits 10% to 15% of cost with the land banker, which is returned pro rata at the takedown of lots. This deposit is the only money at risk for the builder as the land banker owns the land, no loans are involved. Builders use land banking as a bridge to get to their lower cost vertical construction financing. It’s a non-recourse tool builders have increasingly used to scale their business. Land bankers can be an excellent land capital partner. As one builder said, “We find it a risk-free way to grow our business, we know how much is at risk, and we don’t have to worry about guarantees.”

Builders are using single-family build-to-rent (BTR) as a low-risk tool to acquire and develop land, as well as to build and sell homes. Builders are scaling and changing business models, moving toward BTR not only due to the high demand for the product but also because the capital available through various private equity funds are low risk, non-recourse, and abundant. Private equity groups offer a variety of ways builders can utilize their capital and expertise to develop projects, and these groups will contract to purchase all of the homes up front. Not only does the builder have a capital partner but they also have an end buyer, all in one, with little risk. Private equity funds have become quite builder friendly by engaging builders early in the development process and offering capital in a variety of ways. From providing all the equity in the deal to purchasing the land and providing horizontal funding, these groups have becomecreative in order to acquire homes for their portfolios. Builders sell homes at a predetermined price or build on a fee basis.

Builders use a “land light” strategy to fill their lot pipeline without the risk of carrying undeveloped land on their balance sheets. They use lot option agreements to secure finished lots with third-party developers. This keeps their land carrying costs to a minimum and frees up capital for future projects, all while mitigating their risk in a market downturn. In conjunction with this, many home builders develop strong relationships with land developers and become the developer’s first option to purchase its finished lots. The land light acquisition strategy allows builders to control lots according to demand. Some builders will find vacant parcels suitable for development and partner with a land developer to develop the parcel on their behalf. It’s a win-win situation. Not only does the land developer have its project sold easing capital availability, but the home builder has its land pipeline secured according to whatever their projections may be. For example, one developer I work with currently has multiple projects at various stages under contract with a large home builder, providing the builder with 1,000 lots over a 24-month period.

Limited recourse and non-recourse options are more prevalent in today’s lending environment and should be examined. Ask your lender about potential possibilities and terms. Many do not overtly advertise this but do have programs in place, or they may be amenable to certain requests depending on risk analysis. You may pay a little more in interest, and the overall structure may be slightly modified, but the peace of mind and risk reduction is worth it for many builders. There are A&D lenders who specialize in non-recourse, as well as construction lenders who have become competitive with a non-recourse or more of a limited recourse option with construction guarantees. Even when recourse is required by lenders, there are still ways to limit guarantees through various carve-outs and releases. You can request various assets or even one asset be removed from the guarantee, and/or the guarantee gets released or scaled down as certain benchmarks are achieved. It’s best to begin the discussion with your lender early in the process and let it be known that these issues can determine whether you will seek a relationship.

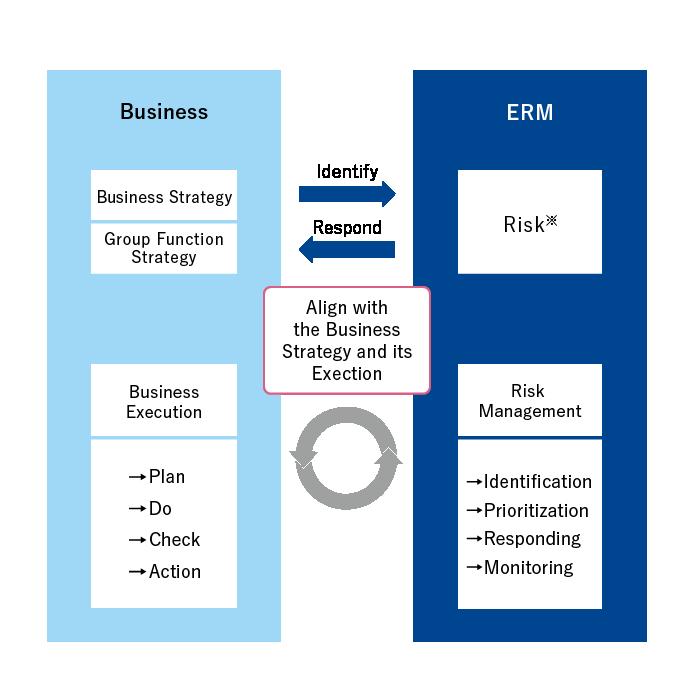

It’s during these robust times that risk management should not be overlooked by home builders. Diversification in business models and capital strategies can reduce exposure creating a more secure environment for the future.