Black Knight's end-to-end, all-in-one technology offers a digital ecosystem designed to support business expansion

-Optimum First Mortgage replaced its current LOS with the cloud-based Black Knight Empower loan origination system, which offers comprehensive, integrated capabilities to support its growth plans and increase profitability

- The mortgage lender currently uses the Optimal Blue Product, Pricing and Eligibility (PPE) Engine

- In addition to the Empower LOS, Optimum First Mortgage will implement multiple other Black Knight origination products, including digital point-of-sale and closing solutions; machine-learning technology; a premier fee service; robust property tax data; automated compliance validation testing; flood zone determination services; and actionable intelligence

JACKSONVILLE, Fla., March 24, 2022 /PRNewswire/ -- Black Knight, Inc. (NYSE:BKI) announced today that Optimum First Mortgage, a hybrid mortgage broker and lender headquartered in Fountain Valley, Calif., has signed a contract to implement the Black Knight Empower loan origination system (LOS) and its suite of integrated solutions to support the company's goals to expand its business and transition to a large-scale lender.

"We wanted to scale our operations, automate processes and support compliance using newer technology," said Matt Dohman, president, Optimum First Mortgage. "Because we'd already been on the Optimal Blue PPE and signed up to use Surefire, Black Knight's CRM and marketing solution, we were familiar with Black Knight's superior technology and knew that it would help our business grow and better prepare our operations for the future."

Optimum First Mortgage will implement the Empower LOS to electronically process loans for its retail and wholesale channels on a single platform. The cloud-based system offers advanced capabilities designed to automate processing of certain tasks based on the lender's configuration with minimal human intervention – often referred to as "lights-out processing." Empower actively monitors for key data changes -- or lack of changes -- and triggers automated or manual tasks to be completed based on lender-configurable logic, when appropriate, further mitigating risk and increasing data integrity.

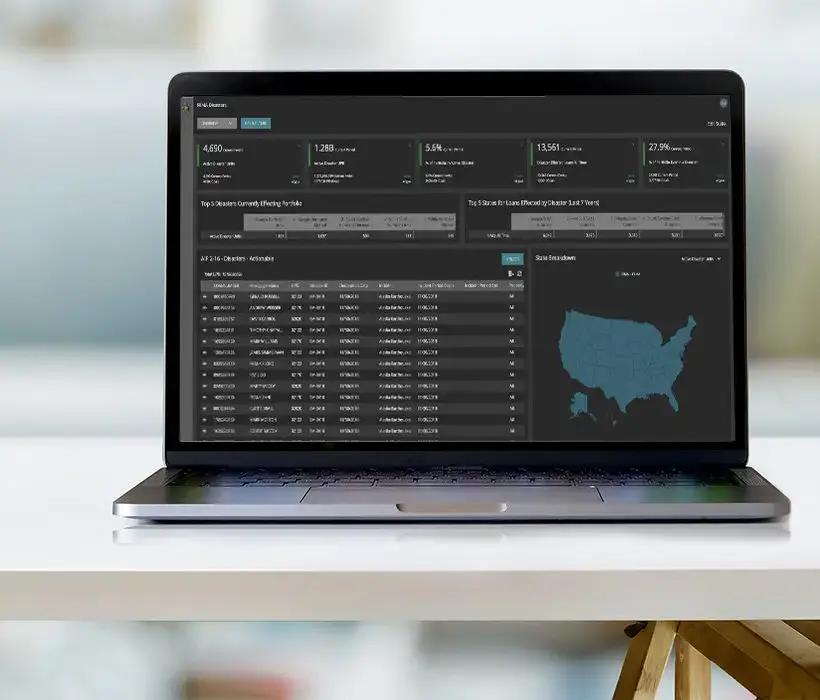

Black Knight's advanced platform also includes a digital point-of-sale solution that enhances the mortgage application process for borrowers and loan officers; machine-learning technology for document classification and indexing; a digital close solution with eDelivery and eSigning capabilities; a comprehensive fee service to help mitigate fee cures; robust property tax data; automated compliance validation testing; flood zone determination services and reporting; and an actionable intelligence solution that delivers instant access to information from multiple data sources to help forecast and monitor pipeline, productivity, cycle time and pull-through. Black Knight will integrate the Optimal Blue PPE engine and the Surefire CRM and Mortgage Marketing solution with the LOS.

"Black Knight is uniquely positioned to help Optimum First Mortgage effectively meet its business goals as the company expands its size and scope," said Rich Gagliano, president, Black Knight Origination Technologies. "By taking advantage of the full integration of Black Knight origination products through our Empower LOS, Optimum First is setting themselves up for even greater success and to better support its customers throughout every part of the loan process."

About Black Knight

Black Knight, Inc. (NYSE:BKI) is an award-winning software, data and analytics company that drives innovation in the mortgage lending and servicing and real estate industries, as well as the capital and secondary markets. Businesses leverage our robust, integrated solutions across the entire homeownership life cycle to help retain existing customers, gain new customers, mitigate risk and operate more effectively.

Our clients rely on our proven, comprehensive, scalable products and our unwavering commitment to delivering superior client support to achieve their strategic goals and better serve their customers. For more information on Black Knight, please visit www.blackknightinc.com.

About Optimum First Mortgage

Optimum First Mortgage has funded over 20,000 loans since its inception and solidified itself as the low price leader in the lending marketplace. Optimum First's sheer volume allows them to just make less per loan than the next guy. They're not looking to make a homerun off a couple loans—they're looking to make a little bit off of a lot of loans. Optimum First Mortgage is a direct lender, but they also have the unique opportunity to broker loans as well. Since Optimum First can broker loans, they have access to about thirty different bank's rate sheets. They use a computer program to sift through these rate sheets on a daily basis, ensuring they offer their clients the most competitive loan pricing available.

For more information: | |

Michelle Kersch | Mitch Cohen |

Black Knight, Inc. | Black Knight, Inc. |

904.854.5043 | 704.890.8158 |

[email protected] | [email protected] |