With few travel or entertainment options, and with many retail businesses shuttered, Home Depot (NYSE:HD) reaped a harvest from the pandemic. Flush with cash from stimulus checks, Americans marched into the home improvement retailer focused on renovation projects.

It is reasonable to question whether the company's ramped up sales can continue with the return to normalcy; however, the age of the average home in the U.S., combined with the paucity of supply, indicates Home Depot has a long growth runway.

Aside from an economic downturn, there is little reason to believe the stock will not provide long-term upside.

Now add in all of the positives a stake in Home Depot provides that few companies can match, and you have a model investment.

Prospects For Growth

One of the primary drivers of growth for HD can be found in the juxtaposition of the age of the average home in the U.S. with housing supply. After all, the very definition of Home Depot is that it is a "home improvement" retailer.

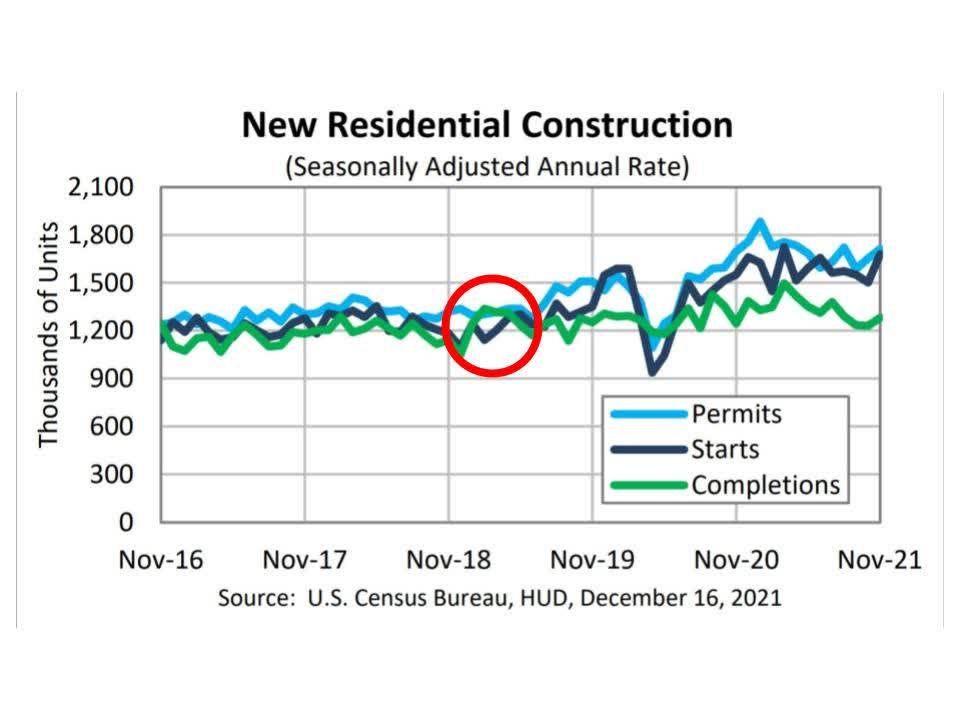

Record-high home prices and a nationwide housing shortage are tag-teaming homeowners. According to Goldman Sachs (GS), the current housing supply is at its lowest level since the 1970s, and the bank expects the shortage to continue for years.

Data provided by Freddie Mac shows the housing supply deficit increased by 52% from 2018 through 2020. Consequently, as of the end of 2020, the U.S. has a housing shortage of 3.8 million units.

Source: Freddie Mac

Due to changing demographics, we are undergoing a national metamorphosis as 11 million seniors leave their homes and are replaced by 15 million younger adults. Younger Americans are 35% more likely to undertake remodeling projects and 40% more likely to take on major projects.

Now factor in that almost half of all homes in the U.S. were built before 1980, and well over a third were built before 1970.

The result is a sustained move towards home remodeling. Global Market Insights projects the home remodeling market will surpass $500 billion in sales by 2023.

The following chart provides data from the National Association of Home Builders for professional remodelers market index.

Source: Qualified Remodeler

The Remodeling Market Index quantifies professional remodelers market outlook. A score of 50 or higher indicates the percentage of remodelers that report activity is higher this quarter than last quarter.

The next chart gives the projected size and rate of big project remodel spend. Big project remodeling is defined as work that equals or exceeds $8,500.

Source: Qualified Remodeler

Projections show 2022 and 2023 will experience the largest total spend in well over a decade, as well as some of the highest annual percentage increases in spending since 2010. While 2021 will likely see a small decline in spending, demand is expected to increase markedly in Q3 and Q4.

These stats are buttressed by a study by Porch.com that shows Google searches for home improvement service projects increased by 50% recently. A survey by Porch.com indicates 75% of respondents completed a major project since the pandemic erupted, and an equal number intend to initiate a second project.

The final chart on this topic provides data on small project remodel spending.

Source: Qualified Remodeler

While the annual percentage increase in spending on smaller projects will be muted, it is imperative to note that the total sums spent far exceed those of the pre-pandemic era.

The data cited above is supported by research conducted by Harvard University.

Home Depot should benefit to a greater extent from the trend to larger projects than rival Lowe's (LOW), as HD draws 45% of sales from contractors whereas 25% of Lowe's sales come from pros.

Why HD Is A Model Investment

Home Depot is a member of an oligopoly that verges on being a duopoly. In 2020, HD and Lowe's posted revenues of $132.1 billion and $89.6 billion respectively. Menards, the third largest home improvement retailer by sales, had less than $11 billion in revenue in FY 2019.

Even so, Home Depot and Lowe's have a combined market share in the U.S. of just 30%, indicating both companies have room for growth.

Home Depot's size creates a scale advantage. This gives the company significant bargaining power with vendors and advertisers. In turn, this provides the company with a competitive pricing advantage.

The company also owns 90% of its stores, including those where the company owns a store on leased ground. HD recently listed the value of its properties at $24.7 billion.

Home Depot is the model of a shareholder friendly company. The firm has a 5- and 10-year dividend growth rate of roughly 20%. While I can be quite critical of ill-timed share repurchases, it is hard to argue with HD's record of stock buybacks. Take a look at the chart below.

Source: Data Macrotrends / Chart by author

Over a period of 15 years, Home Depot roughly halved the number of shares outstanding. Furthermore, management recently announced a new $20 billion share buyback program. This represents over 5% of the current market cap.

HD's credit is rated as A and A2. Both are upper medium investment-grade rankings.

All of this is well enough, but you might wonder how the company is performing now that the economy is reopening. Here are some quick takes from the last quarter.

Customers fulfilled 55% of online orders in store. This practice often leads to additional sales; however, it also points to an additional strength for Home Depot. The nature of many of the retailer's products insulates it from e-commerce competition.

Take it from a guy that performed an extensive DIY remodeling of his home: products sold at HD are either too heavy for potential ecommerce competitors to ship at a profit or many items are needed ASAP, not a day or two later.

Around 20% of the products sold in Home Depot are private labels.

Home Depot also ranks well in terms of customer loyalty.

Source: Place.ai

Dividend And Valuation

The stock has a current yield of 1.98%, a payout ratio of 46.68%, and a five year dividend growth rate of 19.73%. HD increased the dividend by 10% or more every year since 2011.

Home Depot currently trades for $332.84 per share. The average 12-month price target of 25 analysts is $329.92. The average price target of the 6 analysts that provided a new price target following the last quarterly result is $343.00.

HD has a P/E of 24.26x and a forward P/E of 23.50x. That compares to the five year average P/E of 22.90x and forward P/E of 21.56x.

Seeking Alpha calculates the 3 to 5 year PEG at 2.02x. Schwab has a PEG of 2.30, and Yahoo has the 5 year PEG at 3.30.

An Argument For A Buy And Hold Investment Strategy

Buyandhold 2012 provided this pick for me as part of a collaboration I have with him and BM Cashflow Detective. Our goal is to identify stocks to buy in the event of a market meltdown.

Both men have influenced my investment strategy over the years as I slowly evolved from one who traded often to (with very rare exceptions) a buy and hold investor.

Home Depot provides an example of how that philosophy, fueled with due diligence and given time and patience, can lead to market-beating gains.

Consider the results had you invested $1,000 in HD upon its IPO in 1981.

I'll round the numbers so that the initial investment would have resulted in owning 82 shares.

The stock has since split on 13 occasions. Those 82 shares, purchased for $12 apiece, would have multiplied to 28,360 shares. Multiplied again by the current share price of $332.84 gives you over $9,439,000.

Of course that does not include the dividend payments you would have received over the decades. However, today the annual dividend payments would provide you with over $187,000 in annual income alone.

There will be those who will protest that no one has the foresight to invest in that manner. My response is that if one invests in ten well-chosen stocks, nine can be miserable failures, and the tenth will enrich you far beyond most folks' wildest dreams.

My Perspective

A strong prognosticator of Home Depot's growth prospects can be found in the average age of U.S. homes combined with the current and predicted housing supply.

Current housing supply falls far below demand, and a large percentage of America's homes were constructed prior to 1980. Add to this the fact that a younger demographic cohort is supplanting older homeowners, and those buyers are more likely to undertake remodeling projects.

These metrics and trends indicate the surge in home improvement market spending is likely to continue at a robust pace for the foreseeable future.

As outlined in this article, along with a variety of strengths, HD also operates in a near duopoly, it has a long history as a shareholder friendly company, and even as the dominant home improvement retailer, it still only holds a small fraction of the market share.

The only negative I can find regarding a prospective investment in the company is the current share price. Because I demand a better margin of safety in my investments from a valuation perspective, I rate Home Depot as a HOLD.

I will hasten to confess, however, that it would not surprise me if an investment made in HD today outperforms the market by a wide margin over the long term.

While the S&P 500 has increased by a bit over 100% in the last five years, shares of Home Depot are up well over 140% in that time frame, not including dividends.