Q3 gold demand down 7% to 831 tonnes

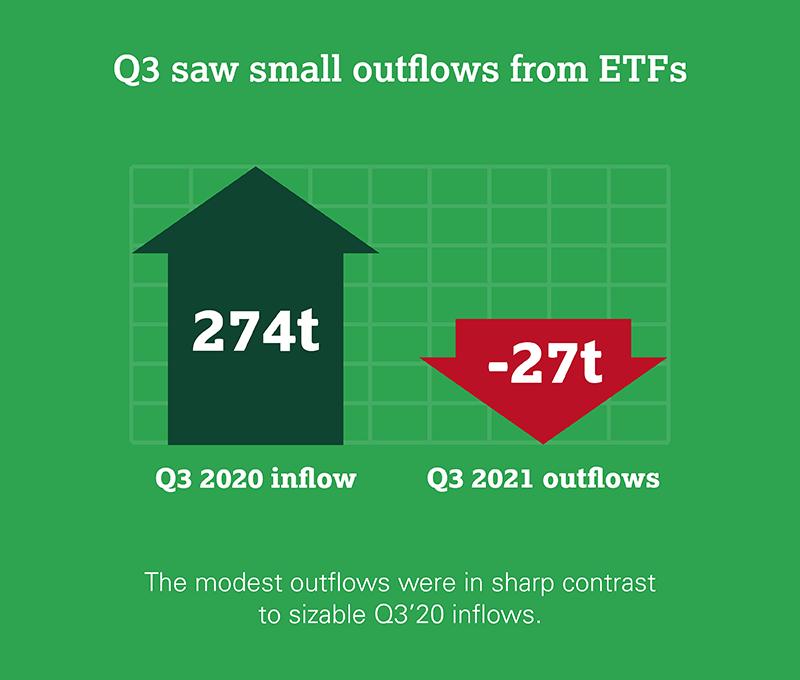

Gold demand (excluding OTC) fell 7% y-o-y to 831t in Q3. This drop was almost exclusively driven by ETFs - which swung from very large inflows in Q3 2020 to modest outflows this year - overshadowing strength in other sectors of demand during the quarter. Jewellery, technology and bar and coin were significantly higher than in 2020. Modest central bank purchases were a solid improvement on the small net sale from Q3'20. Supply was down 3% y-o-y due to a significant drop in recycling.

Jewellery continued to draw strength from the ongoing global economic recovery: Q3 demand rebounded 33% y-o-y to 443t.

Bar and coin investment increased 18% y-o-y to 262t. The sharp August gold price dip was used by many as a buying opportunity.

Small outflows from global gold ETFs (-27t) had a disproportionate impact on the y-o-y change in gold demand, given the hefty Q3'20 inflows of 274t.

Central banks continued to buy gold, albeit at a slower pace than in recent quarters. Global reserves grew by 69t in Q3, and almost 400 y-t-d.

Technology gold demand grew 9% y-o-y, driven by continued recovery in electronics. Demand of 84t is back in line with pre-pandemic quarterly averages.

ETF outflows outweighed continued strong recovery in other sectors of demand.

At 443t, however, demand remained below pre-COVID levels.

The modest outflows were in sharp contrast to sizable Q3'20 inflows.

Q3 demand by sector, tonnes*

Sources: Metals Focus, World Gold Council; Disclaimer

*Data to 30 September 2021.

The gold price averaged US$1,789.5/oz in Q3, marginally lower than the Q2 average. The y-o-y comparison shows a 6% fall, reflecting the August 2020 record high US dollar price. Gold's performance is consistent with its demand and supply dynamics and a macro environment of higher interest rates and risk-on investor appetite.

Year-to-date, gold demand is 9% lower. A doubling of central bank buying and 50% growth in jewellery demand over the first three quarters only partly offset the decline in ETF demand. Y-t-d demand remains notably weaker when compared with the same pre-pandemic period of 2019.

Gold supply is flat y-t-d. Mine production has steadily increased throughout 2021 and the y-t-d total is up 5%, but recycling has slowed down significantly, contracting by more than 12% over the same period.

Our full-year 2021 outlook shows a picture similar to the year so far. Ongoing economic recovery will benefit jewellery and technology; investment should draw support from continued inflation fears but relatively modest ETF flows compare negatively with 2020's record inflows. Central banks are poised for an above-average year of net purchases.

Q3 review and outlook

Q3 started well for gold, boosted by dovish US Federal Reserve rhetoric and sharply lower nominal and real 10-year Treasury yields. The latter dropped to an all-time-low of -1.2% by the beginning of August. However, the positive momentum was short-lived and gold failed to capitalise, edging down 0.6% during a tumultuous but ultimately flat August.

By September, 'gold-positive' news resulted in brief gains, but they could not contain a m-o-m decline of 4%. A persistent rise in the US dollar also took its toll. But despite net outflows from gold ETFs and falling net longs in futures markets, gold ended the quarter down only 1.2%.

This resilience in gold despite visible investment weakness reflects strength not only in consumer and central bank demand but also what's less apparent on the surface:

Gold price in various currencies, indexed to January 2020*

Sources: ICE Benchmark Administration, Refinitiv Datastream, World Gold Council

*Data to 15 October 2021.

Gold holding up well despite 'apparent' underlying investor despondency was one silver lining. Another was the lacklustre performance of both equities and bonds. A general malaise appeared to have taken hold in financial markets during Q3, particularly during September. Seeing bonds and equities fall together ( -4.7% and -0.9% respectively)1runs counter to the experience investors have grown used to for over two decades. Should that continue with gold picking up steam, it could boost gold's appeal as a risk hedge going forward.

Outlook

We anticipate jewellery demand will exceed 2020 levels and have raised our expectations slightly given current weak price performance. Jewellery will likely continue to benefit from the economic recovery. One risk to our view for the full year (FY) 2021 stems from China, where a fallout from property sector woes and power outages might negatively impact demand in Q4. Having said that, we feel that India's stronger than anticipated y-t-d demand can offset potential weakness in China. In all, we tighten our FY2021 jewellery demand range estimate to 1,700-1,800t.

Unsurprisingly given its y-t-d performance, we expect investment demand in total to be weaker in 2021 compared to a stellar 2020. Bar and coin demand has impressed but has been offset by materially weaker-than-anticipated net gold ETF demand. Bar and coin demand should continue to be supported by the macro environment of high inflation prints and economic concerns. One surprising area of strength is the US, where the y-t-d total is the highest in our dataset. This was all the more notable given the weakness in both gold ETFs and COMEX futures.

ETF demand is forecast to be weaker than last year, but the extent of the weakness so far was vastly underestimated given a generally supportive macro picture. On balance, it appears the prospect of a higher interest rate environment is more of a concern than 'transitory' inflation.

A similar pattern has emerged in the futures markets. A continued drop in COMEX net positioning to a six-month low suggested that OTC demand may have gone the way of ETFs, given their linkages. But our OTC estimate, which is part of the balance of demand and supply, remains not only positive so far in 2021 but is sizeable.

We believe that the following factors are at play here:

Central bank demand has surprised to the upside so far in 2021. Y-t-d buying as of Q3 sits at 393t and, based on historical performance and insights from our survey, we wouldn't be surprised to see a figure above 450 by year-end.

With diminishing COVID-19 disruptions and a supportive economic environment, mine supply should have fewer impediments to healthy growth in 2021. However, producer margins have continued their downward trend in Q3 since peaking at the end of 2020. A prolonged continuation of this trend could be headwind to continued production growth at these levels.

Recycling is expected to be marginally lower this year, offsetting growth in mine output. Recycling is expected to contract slightly in 2021 (by between 50-150t). With near-market supplies appearing depleted following two years of relatively elevated activity, healthy economic growth to-date, and a muted gold price in 2021, there has been little incentive or capacity to recycle at recent years' levels. But we remain open to the risk that Q4 could still see economic stress-selling in Asian markets as fallout from China's property market travails and power shortages lingers.

Jewellery

| Tonnes | Q3'20 | Q3'21 | YoY | |

|---|---|---|---|---|

| World total | 332.9 | 442.6 | 33% | |

| India | 60.8 | 96.2 | 58% | |

| China, P.R.:Mainland | 118.5 | 156.8 | 32% |

Source: Metals Focus, World Gold Council

In Q3, gold jewellery demand was driven by economic recovery and improving consumer sentiment, continuing the trend from the first half of the year. Y-t-d, global jewellery demand is almost 50% higher than the same period in 2020.

The US dollar value of jewellery demand grew 25% y-o-y to US$25.5bn. The lower average quarterly gold price offset the 33% increase in demand volumes. Nonetheless, this was the highest value for jewellery demand for a third quarter in eight years.

But the recovery in tonnage fell short of a return to pre-pandemic average levels. Q3 demand was 6% below Q3 2019 and 12% below the five-year quarterly average. Several markets, including Vietnam, Malaysia and Thailand, were disrupted by continued lockdown restrictions.

These restrictions not only impacted the strength of the recovery, but also data collection to some degree. As such, demand estimates may be more susceptible than usual to future revisions, once fieldwork is able to resume as normal.

Jewellery demand, tonnes*

Sources: Metals Focus, World Gold Council

*Data to 30 September 2021.

China

China's gold jewellery demand reached 157t in Q3, 7% higher q-o-q and 32% higher y-o-y. Lower and more stable gold prices, coupled with relatively healthy growth in household disposable income, supported demand.2Almost on a par with Q3 2019, this quarterly level was 7% below the 10-year average from 2010-2019 of 169t.

Three factors stand out:

The sharp price drops in August and September sparked a bout of bargain hunting, which was followed by healthy gifting demand. Chinese Valentine's Day, the Mid-Autumn festival and wedding demand helped to sustain this growth.3

In addition, local jewellery retailers have been increasingly applying a 'per-gram' pricing to their 24K jewellery products and reducing the number of items priced on a 'per-piece' basis in response to consumers' demand for greater transparency. As a result, jewellers focused on selling chunkier, heavier items - which yield higher profits under the per-gram pricing model - lifting China's gold jewellery demand in tonnage terms.

Heritage gold products continued to take centre stage. Local retailers and manufacturers are focusing greater efforts on promoting Heritage gold jewellery items given their growing popularity, with consumers attracted by their traditional cultural designs. These product ranges also benefited from the shift towards 'per gram' pricing.

Hard 24K gold jewellery products' market share remained relatively stable in Q3. These lightweight products continue to attract young consumers. But this sector may face challenges from the shifting pricing methods discussed above. Hard 24K products are largely priced by piece, which could hinder the future expansion of this segment.

The full-year outlook for China's jewellery demand is positive, but not without challenges. Y-t-d demand already exceeds full-year 2020 and Q4 got off to a strong start with robust jewellery sales during the National Day holiday.4But risks remain. China's economic growth faces challenges and should recent power rationing measures continue, this would likely create manufacturing bottlenecks. In view of this, we remain cautiously optimistic about China's gold jewellery demand in the coming months.

India

Jewellery demand in India in Q3 increased approximately 60% both q-o-q and y-o-y, due to strong pent-up demand, a rebound in economic activity and lower gold prices. Having been locked down for much of Q2 to combat the severe second wave of COVID-19, jewellery demand bounced back sharply in the third quarter. An acceleration in the vaccination programme and a strong end to the monsoon season further boosted consumer sentiment.

Occasion-related gift buying witnessed a strong comeback in Q3 and demand was buoyant ahead of the two-week inauspicious Pitru Paksha (or Shraddh) period which fell at the end of September. Retailers anticipating strong demand during the Q4 wedding and festive season built up their inventories in preparation - and reports suggest that it has indeed got off to a brisk start.

At a regional level, Northern India outperformed the South as some Southern states - notably Kerala - were impacted by higher COVID cases and restrictions on store operating times.

Hallmarking activity has gradually increased after some initial teething issues following the introduction of mandatory hallmarking. The industry continues to adapt to the system, which should ultimately improve transparency and give consumers greater confidence in the purity of the gold they buy.

Q4 demand has mixed influences. A higher number of auspicious wedding days bodes well for jewellery demand for the remainder of the year, especially because the good monsoon should support rural incomes. But the potential for further waves of COVID, which may require further lockdowns, is an ever-present threat.

Jewellery demand by country/region, tonnes*

Sources: Metals Focus, World Gold Council

*Data to 30 September 2021.

Middle East & Turkey

Turkish jewellery demand in Q3 jumped 41% compared with Q3'20 - the third consecutive quarterly y-o-y increase. Demand reached 9t - the strongest Q3 since 2017. The lifting of lockdown restrictions released pent-up demand, which was further boosted by relatively low, stable local gold prices during much of the quarter. The resumption of social events - including postponed weddings - had a significant positive impact.

Markets across the Middle East all witnessed y-o-y growth in Q3 jewellery demand, due to a combination of lower and relatively stable gold prices and easing of COVID restrictions. Iran saw a 60% y-o-y rise in demand to 7t, further aided by a period of relative currency stability. Meanwhile, demand in the UAE more than doubled from Q3'20, to reach 8t. Improving tourist arrivals (especially from India) aided the recovery.

The West

Jewellery demand in the US increased by 12% y-o-y to 32t - the highest Q3 since 2009. Continued economic recovery and a successful vaccination campaign helped to fuel the y-o-y growth, which was the more impressive considering that the market had already begun to recover in Q3 last year. Indicative of the strength of jewellery demand, jewellery retail giant Signet raised its third quarter and fiscal 2022 guidance, citing 'continued strong business momentum' and a 'positive response' among customers.5

Demand was 16% lower q-o-q, however. Q2 2021 was a very strong quarter and it is likely that the withdrawal of federal income support in Q3 contributed to this quarterly drop.

Consumer sentiment continued to improve across Europe, reflected in a 19% y-o-y rise in Q3 jewellery demand across the region. Q3 demand increased to 12.2t, which broadly marked a return to pre-COVID levels: Q3'19 demand was 12.4t.

Re-opening of the region's economies following lockdown was the primary driver of growth, albeit that long-haul tourists remained largely absent, which removed a potential element of demand.

ASEAN markets

In Indonesia, Southeast Asia's largest economy, Q3 jewellery demand was 7t, up 56% y-o-y. Demand y-t-d was 31% higher at 17t. Having been hit hard by COVID, jewellery demand remains below pre-pandemic levels. But Q3 was the third consecutive quarter of growth, thanks to a positive economic outlook and the drop in local prices, which made gold jewellery more affordable for low-income consumers.

Jewellery consumption in Thailand rose by 39% y-o-y to 2t. This is the third consecutive quarter of growth, and the increase would likely have been larger had it not been for the second wave of COVID in Bangkok. The main reasons for the recovery were the easing of restrictions and increased vaccination rates, which will eventually facilitate the resurgence of the Thai tourism industry, as well as the revival of manufacturing and exports.

Contrastingly, in Vietnam jewellery demand in Q3 halved y-o-y to 1t. This is the lowest quarter in our GDT data series since 2000. Jewellery consumption was severely affected by the fourth wave of COVID, as all gold jewellery retail outlets in Ho Chi Minh City and the Mekong Delta provinces were closed for much of the quarter. Although online purchases of jewellery are growing, there is still a preference for purchasing from a shop, and these areas typically represent 60% of the retail sales network.

Muted economic sentiment also had an impact. Vietnam's economy contracted for the first time in three decades, and rising inflation and unemployment have led to a decrease in discretionary spending. We expect demand to pick up in Q4, however, as all major gold outlets reopened on 1 October ahead of the coming wedding season and year-end festivities.

Jewellery demand in Singapore declined for the third consecutive quarter to 1t. This is likely due to the intermittent COVID restrictions imposed this year. COVID restrictions had a similar impact in Malaysia, where jewellery consumption slumped by 46% y-o-y. However, with the restrictions starting to ease in both countries we expect to see a rebound in Q4.

Rest of Asia

Jewellery consumption in Japan increased 15% y-o-y to 4t. This is the third consecutive quarterly growth in jewellery demand, although this is from a low Q3'20 base and remains below pre-pandemic levels. COVID has had an impact in Japan, but to a lesser extent than other markets in Asia. While purchases from physical shops are still subdued, there have been strong sales from online channels. There is a small seasonal element to buying in Japan and the bi-annual bonus rounds that take place for many in June and July can have a modest impact on jewellery demand in the third quarter.

South Korean jewellery consumption rose 6% y-o-y to 4t. The stronger demand was in part due to falling prices in advance of the upcoming wedding season.

Investment

| Tonnes | Q3'20 | Q3'21 | YoY | |

|---|---|---|---|---|

| Investment | 495.0 | 235.0 | -53% | |

| Bar & coin | 221.0 | 261.7 | 18% | |

| India | 33.8 | 42.9 | 27% | |

| China, P.R.:Mainland | 57.8 | 64.7 | 12% | |

| Gold-backed ETFs | 273.9 | -26.7 | - |

Source: Metals Focus, World Gold Council

The gold price ended the quarter 1% below where it had begun; a modest rise in July was followed by a sharp price swing in August before slipping back in September. Investment demand was mixed in both its contribution and its response to this price action. ETFs saw modest outflows, while bar and coin investment was boosted in part by investors using price drops as a buying opportunity, in the hope of a rebound.

Outflows from ETFs were mirrored by general apathy in the futures market. Gold trading volumes were relatively subdued, as were COMEX volumes - money manager net long positioning on COMEX fell 40% throughout the quarter.

Investment and other demand in the OTC market remain elevated in 2021, as discussed in the Q3 review and outlook.

ETFs

Gold ETF flows generally moved in step with the gold price during Q3: gains in July were followed by losses in both August and September. The net result for the quarter was a 27t outflow from global gold-backed ETFs. Global holdings at the end of September were just under 3,600t, around 8% below the peak from Q4 2020 of almost 4,000t. Year-to-date outflows total 156t - the largest since 2013.

That being said, it is worth considering ETF flows this year in the context of recent history. Global gold ETFs added more than 1,200t to their holdings between 2019 and 2020. Despite fluctuations in the gold price and rising interest rates, global ETF holdings have since then remained relatively steady, declining by only 7% after peaking at just below 4,000t during Q4 2020.6

Monthly global gold ETF holdings, tonnes, and monthly gold price, US$/oz*

Sources: Bloomberg, Company Filings, ICE Benchmark Administration, World Gold Council

*Data to 30 September 2021.

North American funds were the only region to experience outflows both during the quarter and so far in 2021, losing 2.4% of their assets or 46.3t in Q3. This was driven by strong outflows in the larger, more liquid ETFs, likely being sourced for their liquidity as the price of gold fell. However, low-cost gold ETFs in the US had net inflows of 14.2t or nearly 10% growth in holdings as the low-cost space expanded its product offerings.

European exchange-traded products (ETPs), as they are commonly known, were resilient by comparison: holdings grew by 15t in Q3 as modest outflows in September did not match the inflows from the previous two months. German funds absorbed more than half of all flows into Europe (9t).

Asian-listed funds again saw the largest growth in relative - if not absolute - terms. Holdings grew by 4t (3%) as investment demand remained strong amid volatile local equity markets, while gold price dips also provided opportunities for some to build their gold positions. Much of the region's growth came from China, where 3t of inflows took holdings in Chinese gold ETFs to 72t. Interest in gold ETFs was spurred by turbulence in the local stock market, which culminated in a 7% fall in the CSI300 stock index during the quarter - its largest quarterly loss since Q1'20. The gold price drops in the third quarter were also a likely prompt for investors to increase their allocations.

Funds listed in other regions saw minor inflows of 0.2t during the third quarter, supported by weakness in emerging market equities.

Bar and coin

Global bar and coin demand in Q3 reached 262t, an 18% y-o-y increase. Growth was driven by a 56% increase in global bar investment (to 178t). This was countered by a 29% decline in demand for official coins to 59t, almost entirely due to a sharp reduction in Turkey's coin purchases from last year's record high.

The y-t-d total of 857t is the highest since 2013 - a time when demand rocketed, especially in Asian markets, as investors made the most of a sharp price drop to build holdings.

Strong Q3 growth was underpinned by a range of factors, including ongoing emergence from COVID restrictions in many countries, continued fears over rising inflation and the price dip in August which encouraged many investors to buy (particularly in Asia). Thailand had an outsized impact on the y-o-y comparison due to the swing in that market from strong net sales in Q3'20 (-45t) to modest net buying (7t) in the recent quarter.

Global bar and coin investment, tonnes*

Sources: Metals Focus, World Gold Council

*Data to 30 September 2021.

China

China's Q3 bar and coin demand grew 12% y-o-y to 65t. Bar and coin sales were mainly supported by a lower local gold price, gifting demand, healthy household income growth, and local commercial banks shifting their focus to selling physical gold bars and coins.

The local price of gold was relatively stable in Q3, aside from a couple of sharp dips in August and September, which provided bargain hunters with the opportunity to buy at lower prices. This was well timed, helping to boost gifting around the Mid-Autumn festival. Household incomes steadily increased during the quarter, which helped lift both jewellery and bar and coin sales. Additionally, local commercial banks increased their efforts around gold bar and coin sales as they gradually exit their paper gold trading and Shanghai Gold Exchange gold contract brokerage businesses.

Looking ahead, investment demand for gold should remain robust in Q4. As a non-renminbi, counter-cyclical asset, we believe gold could increasingly appeal to local investors as pressure on China's economic growth intensifies. In addition, with other gold trading businesses suspended, we expect Chinese commercial banks to maintain their efforts in selling gold bars and coins.

India

Indian Q3 bar and coin investment increased 27% y-o-y - to 43t - on pent-up demand and the gold price dip. Aligned with jewellery consumers, bar and coin investors responded to the sharp price dip, and lower average quarterly price, by adding to their holdings. The price effect was heightened by the release of pent-up demand as lockdown restrictions eased. Although investors were tempted by equity market strength (the BSE SENSEX touched an all-time high of 60,000 on 24 September), they remained wary of possible corrections amid such lofty valuations. This encouraged investment in gold for diversification purposes.

Development of digital platforms opens further channels for gold investors. The launch of digital gold platforms by retailers such as Titan, Kalyan and Senco Gold provides Indian investors with a convenient way to make systematic investments in gold for as low as Rs100.

The quarter saw continued policy reforms related to domestic spot gold exchange and international bullion exchange. During Q3, the Securities and Exchange Board of India (SEBI) approved the framework for domestic spot exchange in India. Meanwhile, the International Financial Services Centres Authority (IFSCA) launched the India International Bullion Exchange (IIBX) on 1 October 2021. These exchanges, intended to empower bullion banking and establish India as a major bullion trading hub, may also help with the successful implementation of the gold monetisation scheme and the development of gold-backed products.

Middle East and Turkey

Bar and coin demand in Turkey was sharply lower y-o-y. Demand for small gold bars and coins was 10t - 80% below the record high of Q3'20, although it staged a strong quarterly recovery from Q2's very depressed level. The gold price remains at historically very elevated levels, at a time when Turkey is plagued by persistent high inflation.

In a repeat of Q2, Iran - the largest market in the Middle East - was the only country to register y-o-y losses. Bar and coin investment in Iran fell 30% y-o-y to 8t as high inflation and housing costs continued to weigh on demand. Lower gold prices and summer wedding demand offered some support - and help explain the very strong quarterly uplift from the weak Q2. Markets across the rest of the Middle East saw solid y-o-y improvement, likely supported by the price correction mid-quarter.

The West

Bar and coin investment in the US grew 31% to 29t. Retail investment continued to draw strength from the environment of low interest rates and rising inflation. Furthermore, the combination of rising wages and limited opportunities for discretionary spending increased the disposable incomes available to allocate to gold investment.

Although the pace of investment slowed from the first half of the year, investment remains very elevated when compared with historical norms: the five-year quarterly average is 13t. Y-t-d investment reached a record of 91t. Q4 has apparently started well, potentially putting the full-year record from 2009 (114t) within reach.

Europe saw strong growth: up 22% to 58t. Germany was the main driver of growth: demand exceeded the already elevated levels from Q3'20 although did not quite maintain the momentum from the first half of the year. Demand in the UK jumped to more than 5t - the highest for almost 10 years.

ASEAN

Retail investment in bars and coins in Indonesia increased by 15% y-o-y to 6t. This is the highest in absolute terms since Q4 2014. The stronger appetite for gold bars and coins can be attributed to concerns about inflation, the depreciation of the rupiah against the US dollar, and anticipation of rising gold prices.

In Thailand, retail investment moved from a net disinvestment of -45.2t to a net positive of 7t in Q3. On a q-o-q basis retail bar and coin demand grew by 18%. Thai investors seem to have taken advantage of an 8% drop in the local gold price. The weakening of the Thai baht against the US dollar has also had an impact, with Thai investors looking to preserve their wealth and hedge against inflation.

Vietnamese retail investment halved to 2t, significantly below pre-pandemic levels. The significant decline coincides with the timing of COVID lockdowns, but bar and coin demand was slightly cushioned as some major commercial banks could still operate in-store retail gold counters. As with jewellery demand, muted economic sentiment has significantly impacted demand for bars and coins.

Both Malaysia and Singapore saw a y-o-y decrease in bar and coin demand: down 52% and 23% respectively. This is likely due to a combination of COVID restrictions and economic uncertainty denting consumer confidence. Although economic forecasts have been revised upwards in both markets, this will take time to change consumer sentiment.

Rest of Asia

Net retail investment in Japan was positive but modest at 2t. Like jewellery, the recent corporate bonus rounds will have boosted demand for bars and coins. The net positive y-t-d investment bucks the recent trend of net disinvestment of bars and coins in Japan. Many people in Japan accumulated gold during the boom of the 1980s, and as these people have retired in recent years many have taken advantage of the significant growth in gold prices.

Central Banks and other institutions

| Tonnes | Q3'20 | Q3'21 | YoY | |

|---|---|---|---|---|

| Central banks & others | -10.6 | 69.3 | - |

Source: Metals Focus, World Gold Council

Central bank gold buying in Q3 was modest by recent standards. Net purchases slowed to 69t from 191t in Q2. This contrasts with Q3'20, which was the first quarter of net central banks selling since 2011. Y-t-d buying had reached 393t by the end of Q3, more than double over the comparable period in 2020.

Buying concentrated among a small, familiar group. Q3 central bank activity was not boosted by the large-scale purchases seen during H1. Demand nevertheless remained robust, with moderate levels of buying by several familiar names.

Central bank net purchases in tonnes*

Sources: Metals Focus, World Gold Council

*Data to 30 September 2021.

The Reserve Bank of India (RBI) was the largest buyer in Q3. Gold reserves grew by 41t to 745t. This marks a slight increase in the pace of buying by the RBI, and 2021 looks set to see the biggest annual increase in India's official gold reserves since 2009.7

The Central Bank of Brazil added a further 9t in Q3, having been one of the largest buyers in H1. Gold reserves now stand at 130t (+92% y-t-d). Uzbekistan (26t), Kazakhstan (7t), and Russia (6t) were the other major buyers in the quarter. It should be noted that we believe that Russia's purchases were a likely rebalancing of its gold reserves following a few months of coinage-related sales earlier in the year. The Philippines and Mongolia also increased their gold reserves in Q3, both by just under a tonne.

Poland's gold reserves were unchanged on a net basis over the quarter. In early October, however, central bank Governor Adam Glapinski indicated that it has initial plans to buy a further 100t of gold in 2022.

Relatively subdued selling completes the picture. Only a few central banks reduced their gold holdings in Q3, with gross sales totalling 27t. Turkey sold 13t during the quarter, as a chunky sale in September outweighed small monthly purchases in July and August. The country continues to face economic challenges, including sustained currency weakness, which has kept local currency prices of gold close to record highs. Qatar (3t) was the only other notable seller.

Central bank demand remains one of the highlights of the gold market so far this year. And despite purchases easing in Q3, we believe that central banks continue to view gold positively. As such, our expectation is for net buying in Q4 to generate full-year purchases broadly in line with the average for the past five years (458t).

Technology

| Tonnes | Q3'20 | Q3'21 | YoY | |

|---|---|---|---|---|

| Technology | 77.2 | 83.8 | 9% | |

| Electronics | 63.2 | 68.9 | 9% | |

| Other Industrial | 10.9 | 12.0 | 10% | |

| Dentistry | 3.1 | 2.9 | -8% |

Source: Metals Focus, World Gold Council

Electronics

Gold used in the electronics sector continued to recover. As large parts of the world emerged from the COVID-19 pandemic, improving consumer confidence created strong demand for big ticket items such as vehicles and high-end consumer electronic devices. Q3 also saw notable product launches from major manufacturers such as Samsung (OTC:SSNLF) and Apple (AAPL),8further bolstering confidence in the sector. The shift towards home working in some parts of the world continued, but demand for related devices is slowing as saturation nears. The industry is also facing some major structural challenges that may impact demand in the coming quarters; these are discussed in more detail below.

The memory sector performed strongly, lifted by healthy consumer electronics demand. Inventory building by device manufacturers has pressured component suppliers' inventories, and this will likely support gold demand through to the end of 2021 as major suppliers look to rebuild these stocks. Samsung, the world's largest DRAM and NAND manufacturer, recently reported its highest profit in three years on the back of memory chip price rises and strong device sales.9However, there are potential headwinds: memory demand in laptop and PC devices is likely to fall as home working slows. NAND chips also continue to undergo technology advances, with stacking technology set to increase in 2022.10This will likely reduce the volume of gold required per chip, but increased wafer output may offset this.

The Printed Circuit Board (PCB) sector also had a strong quarter, reflecting robust demand across each end-product segment. Healthy PC shipments and smartphone launch provided strong support during Q3, alongside rapid developments in aerospace applications which continued to fuel demand for High Density Interconnect (HDI). HDI tends to have a higher wiring density per unit area than traditional PCBs, and hence uses more gold. Strong demand from high-performance computing, artificial intelligence, and 5G infrastructure applications also contributed to demand during the quarter.

LED demand registered a small fall as migration to mini-LED continued. Following the traditionally busy second quarter (where LED demand spikes as new consumer electronic devices are assembled in preparation for Q3 launches) the third quarter tends to be the slowest of the year in the LED market, and this was exacerbated by the ongoing implementation of mini-LED technology in some markets (mini-LED requires smaller quantities of gold bonding wire than traditional LEDs). Previous expectations were for mini-LED to be a 'transitioning technology' as the industry moves towards gold-free micro-LEDs, but this now appears less certain as manufacturers increasingly invest in mini-LED and product launches are slated to ramp up in 2022 in the consumer electronics sector. Finally, infrared and ultraviolet LEDs (IR LED and UV LED) are increasingly being incorporated in a range of household appliances and wearable technologies. Although currently a minor component of the overall LED sector, demand for these products is experiencing notable growth rates.

Demand in the wireless sector remained healthy. Ongoing 5G infrastructure deployment in many countries around the world continues to provide strong support for wireless technology. Additionally, many new smartphones are now 5G-enabled, which requires increased use of power amplification chips. Other high-tech sectors continue to provide growth opportunities, such as the expansion of automation technology, a buoyant satellite technologies sector, and ever-increasing vehicle electrification. However, gold usage in this sector faces threats in certain areas. Recent reports suggest that certain Android manufacturers have changed their designs to eliminate 3D sensing in mobile devices due to the cost increase when upgrading from 4G to 5G technology. Additionally, Huawei, a major Android device maker, continues to face severe US sanctions, ultimately threatening gold demand for use in their devices.

While Q3 performance was strong, the sector faces notable challenges in coming quarters. Widely reported chip shortages in the automotive sector appear to have worsened and are severely impacting new vehicle sales worldwide. Total auto sales in China, for example, suffered in September 2021, with most manufacturers reporting notable falls.11These shortages are also spreading to other parts of the industry. Apple, for example, recently indicated that it is likely to deliver 10 million fewer units of its new flagship iPhone 13 in 2021, citing supply issues from chip manufacturers such as Broadcom and Texas Instruments.12These significant industry-wide challenges are likely to create uncertainty in the coming quarters.

Another looming challenge for the industry relates to energy availability. Many industries in major provinces in China have been impacted by power rationing and enforced cuts in a drive to meet targets for reducing energy and emission intensity.13With over 50% of the world's 2,600 PCB factories being based in China, this threatens to have a significant impact on PCB supply. Some manufacturers have already reported major production halts, and the impact of this is likely to feed through into the broader supply chain during Q4'21 and beyond.

On a country level, each of the four major electronics fabrication hubs around the world again recorded increases in gold demand during Q3. Japan, Mainland China and Hong Kong SAR, South Korea and the US recorded increases of 10.3%, 6.9%, 9.4%, and 12.3%, respectively.

Other industrial & dentistry

Other industrial applications recorded a y-o-y increase of 10% to 12t in Q3. Growth was largely due to stronger than expected demand for plating salts used in luxury accessories and costume jewellery However, the use of gold in dental applications dropped 8% y-o-y to 3t in Q3. This reversed Q2's rise as the previous boost from postponed dental work faded and the ongoing structural decline (the shift to non-precious metal alternatives) reasserted itself.

Supply

| Tonnes | Q3'20 | Q3'21 | YoY | |

|---|---|---|---|---|

| Total supply | 1,279.4 | 1,238.9 | -3% | |

| Mine production | 919.0 | 959.5 | 4% | |

| Net producer hedging | -21.3 | -18.6 | - | - |

| Recycled gold | 381.8 | 298.0 | -22% |

Source: Metals Focus, World Gold Council

Q3 mine production increased by 4% y-o-y as there were fewer COVID-19 production interruptions compared to last year. But underlying production growth was demonstrated by the 3% increase compared to 2019 pre-pandemic levels. A lower gold price during the quarter and evidence of depleted near-market supply of old jewellery saw recycled gold supply 22% lower y-o-y. Recycled supply has consistently fallen y-o-y in each quarter of 2021 so far.

Mine production

Third quarter mine production is estimated at a record 959t. But due to downward revisions to the last two quarters, y-t-d production of 2,679t was slightly below the record set in 2018, when mine production reached 2,704t for the first nine months of the year. Q3'21 mine production was 9% higher q-o-q due to seasonal increase in output from high latitude alluvial operations and some back-loaded production profiles at some conventional operations in North America. Higher output from the vast copper-gold operations of Grasberg in Indonesia and Oyu Tolgoi in Mongolia contributed to this growth, continuing the theme from previous quarters of this year.

Quarterly global mine production, tonnes*

Sources: Metals Focus, Refinitiv GFMS, World Gold Council

*Data to 30 September 2021.

Recovery from COVID-related disruptions has been a common theme this year, although this effect waned in the most recent quarter because the worst disruption occurred in the first half of 2020. Peru was an exception: Q3 production increased by 25% y-o-y, as COVID-19 had the most damaging impact in Q3'20. South Africa saw an 18% y-o-y increase in Q3'21 due to the long lead time in restoring production from deep underground operations. Canadian production increased 23% y-o-y due to the ramp-up of production from new projects, increased output at Detour Lake, and the return of Musselwhite to full production rates following a fire in Q1'19.

Technical and safety issues were responsible for the most significant declines in output seen in the third quarter. Production fell 34% y-o-y in Mauritania after a mill fire at the Tasiast mine in June led to a suspension of milling operations. This is planned to be back online in Q4'21. In Turkey, lower grades at Kisladag and Oksut saw Turkish production down 18% y-o-y. Safety checks in mines in the Shandong Province, together with country-wide environmental pressure saw production from China down 6% y-o-y. The suspension of the Obuasi mine in Ghana following a fatal accident contributed to a 5% decline in Ghanian mine production in Q3'21.

The costs of mining gold continued to increase in Q2'21, the latest available data. The average All-In Sustaining Cost hit US$1,067/oz in the second quarter, the highest level seen since 2014 and up 10% y-o-y. Total cash costs increased by 9% to US$776/oz. The main drivers of this cost pressure were producer currency strength; higher sustaining capital expenditure; lower grades and recovery rates; and input cost inflation. Some ongoing costs to mitigate the risks of COVID-19 also continue to be borne by mining companies.

Despite the revisions to H1'21 mine production estimates - and in the absence of renewed COVID-19 disruptions - annual mine production is still on track to recover ground lost in 2020. Production ramp-ups at the underground block cave at Grasberg in Indonesia, new projects/expansions, and some higher grades in North America look set to more than offset ore reserve depletion and lower grades at other mines.

Net producer hedging

It is estimated that gold miners reduced their aggregate hedged position by 19t in Q3'21. Initial estimates (subject to revisions once most companies have released quarterly reports) suggest a decline in the global delta-adjusted hedge book of 19t in Q3'21. After a smaller than expected contraction of the aggregate industry hedge book of 15t in the second quarter, the y-t-d decline is estimated at 25t, equating to a 77t decline since the start of 2020.

A slightly lower average quarterly gold price, down 1% q-o-q, is not expected to have prompted major new hedging as producers appear to prefer to keep production exposed to the spot gold price. The only additions expected are from companies required to add new positions due to debt finance requirements.

Recycled gold

Recycling remained weak in Q3'21 at 298t. In the third quarter, recycled gold supply was sharply lower, down 22% y-o-y and off 16% compared to Q3 2019. But recycling activity was 6% higher q-o-q at 298t despite the 2% fall in the average US dollar gold price over the period.

Quarterly y-o-y change in recycling supply, %, and quarterly average price, US$/oz*

Sources: ICE Benchmark Administration, Metals Focus, World Gold Council

*Data to 30 September 2021.

There are three major reasons for the decline in recycling during the third quarter.

Virtually every country saw y-o-y declines in the supply of recycled gold. The only notable exception was Sri Lanka, where the ongoing economic crisis triggered further distress selling. Two countries made the greatest contribution to the fall in recycled gold supply. Thailand, where distress selling rocketed in 2020, saw a return to more typical levels as economic prospects began to improve and the pool of gold to recycle had been materially drawn down. And in India, the supply of recycled gold halved y-o-y as the economy started to rebound, the annual monsoon rains ended strongly (with cumulative rainfall just 0.7% below long-term averages) and the average gold price was lower and relatively subdued compared with Q3'20. Indian recycling levels remain a little elevated, however, partly due to sales from gold loan companies, where some borrowers had defaulted.

Q3'21 recycled gold supply fell slightly y-o-y in China but jumped by 27% q-o-q. The reasons for this appear to be seasonal: many manufacturers and refineries utilise the Shenzhen Jewellery Fair and associated events, held in September each year, to actively promote new products and designs to the trade; this often triggers jewellery retailer flows of unsold stock from previous campaigns.

Most other regions, including Europe, the Middle East and the Far East, saw recycled supply declines. The US was the sole outlier: recycling flows were roughly flat. Although some areas of the US saw declines, driven by global trends, renewed access to previously shuttered retail outlets allowed some selling that hadn't been possible during the pandemic.

We believe that recycling is likely to remain subdued over the next few quarters. The need for significant increases in the gold price, continued recovery in the global economy, and a smaller pool of near-market supplies create headwinds. In the first three quarters of 2021 a 12% y-o-y fall in recycled gold virtually offset the impact of rebounding mine production - which increased 5% over the same period - highlighting the importance of this component of the gold supply/demand balance.

Executive summary

Q3 demand by sector, tonnes*

Sources: Metals Focus, World Gold Council

*Data to 30 September 2021.

Q3 review and outlook

Gold price in various currencies, indexed to January 2020*

Sources: ICE Benchmark Administration, Refinitiv Datastream, World Gold Council

*Data to 15 October 2021.

Jewellery

Jewellery demand, tonnes*

Sources: Metals Focus, World Gold Council

*Data to 30 September 2021.

Jewellery demand by country/region, tonnes*

Sources: Metals Focus, World Gold Council

*Data to 30 September 2021.

Investment

Monthly global gold ETF holdings, tonnes, and monthly gold price, US$/oz*

Sources: Bloomberg, Company Filings, ICE Benchmark Administration, World Gold Council

*Data to 30 September 2021.

Global bar and coin investment, tonnes*

Sources: Metals Focus, World Gold Council

*Data to 30 September 2021.

Central banks

Central bank net purchases in tonnes*

Sources: Metals Focus, World Gold Council

*Data to 30 September 2021.

Supply

Quarterly global mine production, tonnes*

Sources: Metals Focus, Refinitiv GFMS, World Gold Council

*Data to 30 September 2021.

Quarterly y-o-y change in recycling supply, %, and quarterly average price, US$/oz*

Sources: ICE Benchmark Administration, Metals Focus, World Gold Council

*Data to 30 September 2021.

Notes

Revisions to data

All data is subject to revision in the light of new information.

Historical data series

Demand and supply data from Q1 2014 are provided by Metals Focus. Data between Q1 2010 and Q4 2013 is a synthesis of Metals Focus and GFMS, Thomson Reuters data, which was created using relatively simple statistical techniques. For more information on this process, please see Creating a consistent data series by Dr James Abdey.

Definitions

Central banks and other institutions

Net purchases (i.e. gross purchases less gross sales) by central banks and other official sector institutions, including supra national entities such as the IMF. Swaps and the effects of delta hedging are excluded.

Consumer demand

The sum of jewellery consumption and total bar and coin investment occurring within a country i.e. the amount (in fine weight) of gold purchased directly by individuals.

Electronics

This measures fabrication of gold into components used in the production of electronics, including - but not limited to - semiconductors and bonding wire.

Dentistry

The first transformation of raw gold into intermediate or final products destined for dental applications such as dental alloys.

Gold-backed Exchange-Traded Funds and similar products (ETFs)

Exchange-Traded Funds and similar products including, but not limited to: SPDR Gold Shares, iShares Gold Trust, ZKB Gold ETF, ETFS Physical Gold/Jersey, Gold Bullion Securities Ltd, Central Fund of Canada Ltd, Xetra-Gold, Julius Baer Precious Metals Fund - JB Physical Gold Fund, Source Physical Gold P-ETC, Sprott Physical Gold Trust, Huaan Yifu Gold ETF, Japan Physical Gold ETF, R*Shares Gold BeES, Bosera, Gold ETF. Over time, new products will be included when appropriate. Gold holdings are as reported by the product issuers. Where data is unavailable, holdings have been calculated using reported AUM numbers. For a comprehensive list of the funds we track or to subscribe to our monthly update on gold-backed ETF holdings, visit /goldhub/data/global-gold-backed-etf-holdings-and-flows.

Fabrication

Fabrication is the first transformation of gold bullion into a semi-finished or finished product.

Gold demand

The total of jewellery consumption, technology fabrication, investment and net purchases by central banks.

Gold demand (fabrication basis)

The total of jewellery fabrication, technology fabrication, investment and net purchases by central banks.

Jewellery

End-user demand for all newly-made carat jewellery and gold watches, whether plain gold or combined with other materials. Excluded are: second-hand jewellery; other metals plated with gold; coins and bars used as jewellery; and purchases funded by the trading-in of existing carat gold jewellery.

Jewellery fabrication

Jewellery fabrication is the first transformation of gold bullion into semi-finished or finished jewellery. Differs from jewellery consumption as it excludes the impact of imports/exports and stocking/de-stocking by manufacturers and distributors.

LBMA Gold price PM

Unless otherwise specified, gold price values from 20 March 2015 are based on the LBMA Gold price PM administered by ICE Benchmark Administration (IBA), with prior values being based on the London PM Fix.

London PM Fix

Unless otherwise specified, gold price values prior to 20 March 2015 are based on the London PM Fix, with subsequent values being based on the LBMA Gold price

PM administered by ICE Benchmark Administration (IBA).

Medals/imitation coin

Fabrication of gold coins without a face value, produced by both private and national mints. India dominates this category with, on average, around 90% of the total. 'Medallion' is the name given to unofficial coins in India. Medals of at least 99% purity, wires and lumps sold in small quantities are also included.

Mine production

The volume (in fine weight) of gold mined globally. This includes an estimate for gold produced as a result of artisanal and small scale mining (ASM), which is largely informal.

Net producer hedging

This measures the impact in the physical market of mining companies' gold forward sales, loans and options positions. Hedging accelerates the sale of gold, a transaction that releases gold (from existing stocks) to the market. Over time, hedging activity does not generate a net increase in the supply of gold. De-hedging - the process of closing out hedged positions - has the opposite impact and will reduce the amount of gold available to the market in any given quarter.

Official coin demand

Investment by individuals in gold bullion coins. It equates to the fabrication by national mints of coins which are, or have been, legal tender in the country of issue. It is measured at the country of consumption rather than at the country of origin (for example, the Perth Mint in Australia, sells the majority of the coins it produces through its global distribution network) and is measured on a net basis. In practice it includes the initial sale of many coins destined ultimately to be considered as numismatic rather than bullion.

Other industrial

Gold used in the production of compounds, such as Gold Potassium Cyanide, for electro-plating in industrial applications as well as in the production of gold-plated jewellery and other decorative items such as gold thread. India accounts for the bulk of demand in this category.

Over-the-counter

Over-the-counter (OTC) transactions (also referred to as 'off exchange' trading) take place directly between two parties, unlike exchange trading which is conducted via an exchange.

Physical bar demand

Investment by individuals in small (1kg and below) gold bars in a form widely accepted in the countries represented within Gold Demand Trends. This also includes, where identifiable, gold bought and stored via online vendors. It is measured as net purchases.

Quarter-on-quarter (q-o-q)

The change in a quarterly data series from the previous quarter.

Recycled gold

Gold sourced from fabricated products that have been sold or made ready for sale, which is refined back into bullion. This specifically refers to gold sold for cash. It does not include gold traded-in for other gold products (for example, by consumers at jewellery stores) or process scrap (working gold that never becomes part of a fabricated product but instead returns as scrap to a refiner). The vast majority - around 90% - of recycled gold is high-value gold (largely jewellery) and the remainder is gold recovered from industrial waste, including laptops, mobile phones, circuit boards etc. For more detail on recycling, refer to The Ups and Downs of Gold Recycling, Boston Consulting Group and World Gold Council, March 2015.

Surplus/deficit

This is the difference between total supply and gold demand. Partly a statistical residual, this number also captures demand in the OTC market and changes to inventories on commodity exchanges, with an additional contribution from changes to fabrication inventories.

Technology

This captures all gold used in the fabrication of electronics, dental, medical, decorative and other technological applications, with electronics representing the largest component of this category. It includes gold destined for plating jewellery.

Tonne (Metric)

1,000 kg or 32,151 troy oz of fine gold.

Total bar and coin investment

The total of physical bar demand, official coin demand and demand for medals/imitation coin.

Total supply

The total of mine production, net producer hedging and recycling.

Year-on-year (y-o-y)

The change in a data series from the corresponding period of the previous year.

Year-to-date (y-t-d)

In Gold Demand Trends, year-to-date refers to the period to the end of the quarter being reviewed (i.e. for Gold Demand Trends Q2 2017, 'year-to-date' referred to the period from 31/12/2016 to 30/06/2017)

Gold Demand Trends explained: data sources & analysis

This video explains how we create Gold Demand Trends, the leading industry resource for gold demand data. We explain how our unique position in the gold industry gives us unparalleled market insight and how we work to understand evolving consumer behaviours, identify emerging trends, and apply our knowledge and experience to provide a complete view of the gold market.

Footnotes

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.