The Rules for These Plans Are Specifically Defined by the IRS

ByLouise Norris Louise NorrisLouise Norris has been a licensed health insurance agent since 2003 after graduating magna cum laude from Colorado State with a BS in psychology.Learn about our editorial processUpdated on November 18, 2021Fact checkedVerywell Health content is rigorously reviewed by a team of qualified and experienced fact checkers. Fact checkers review articles for factual accuracy, relevance, and timeliness. We rely on the most current and reputable sources, which are cited in the text and listed at the bottom of each article. Content is fact checked after it has been edited and before publication. Learn more.byElaine Hinzey, RD Fact checked byElaine Hinzey, RDElaine Hinzey is a registered dietitian, writer, and fact-checker with nearly two decades of experience in educating clients and other healthcare professionals.

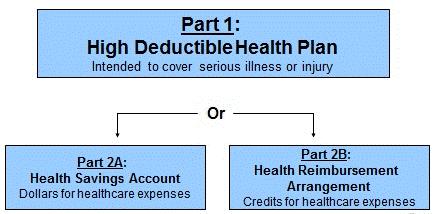

Learn about our editorial processThe term "high deductible health plan" probably sounds pretty self-explanatory. But it's actually an official term that the IRS defines—it doesn't just mean any health plan with a high deductible.

This article will describe what a high-deductible health plan is, how they're regulated, how they work with health savings accounts, and how they differ from other types of health coverage.

High deductible health plans—often referred to as HDHPs—have to follow three rules:

A high deductible health plan is not the same thing as a catastrophic health plan. "Catastrophic" is a term that was used in the past to describe any health plan with high out-of-pocket costs, but the ACA created a specific definition for it.

Catastrophic health plans are only available to people under the age of 30 and to people who have hardship exemptions from the ACA's individual mandate. And catastrophic plans can never be HDHPs because they cover three non-preventive office visits pre-deductible and have out-of-pocket exposure that's higher than the limits imposed for HDHPs.

You Need an HDHP in Order to Contribute to an HSA

If you want to be able to contribute to a health savings account (HSA), you need to have coverage under an HDHP. And again, that doesn't just mean any plan with a high deductible. This can be a point of confusion, as people sometimes assume that they can contribute to an HSA as long as their health plan has a high deductible—but it needs to be an actual HDHP that follows the IRS rules for that type of plan.

Along with having HDHP coverage, you also can't have any other additional health plan—with limited exceptions for supplemental coverage—and you can't be claimed as a dependent on someone else's tax return.

If you meet these rules, you're considered HSA-eligible, which means you can make contributions to an HSA (or someone else, including an employer, can make contributions to your HSA on your behalf).

There's a special rule that allows a person to make the maximum annual contribution to an HSA if they enroll in an HDHP mid-year (even if it's as late as December 1), but then they must remain covered under an HDHP for the entire following year.

Otherwise, HSA contributions cannot be made for any month that you're not HSA-eligible. So for example, if you turn 65 and enroll in Medicare, you have to stop contributing to your HSA, even if you're continuing to work and you're still enrolled in your employer's HDHP.

Deductibles on Non-HDHPs Have Rapidly Increased

As deductibles on all health plans have increased over the years, the minimum deductibles for HDHPs aren't really that "high" anymore, relative to the deductibles on non-HDHPs. In fact, it's common to see non-HDHPs that have deductibles that are quite a bit higher than the deductibles on HDHPs.

HSAs and the rules for HDHPs were created under the Medicare Prescription Drug Improvement and Modernization Act in 2003, and first became available for consumers in 2004. At that point, the minimum HDHP deductible was $1,000 for a single individual and $2,000 for family coverage. Since then, the minimum HDHP deductible has increased by 40%, to $1,400 and $2,800, respectively, for 2022 (unchanged since 2020, but higher than they were in previous years).

But when we look at deductibles in general, they've increased much more significantly. In 2006, the average deductible on an employer-sponsored plan was just $303. By 2021, it had grown by more than 450%, to $1,669.

So, average deductibles on all types of employer-sponsored plans have increased much faster than the minimum deductibles for HDHPs, reaching a point where the average deductible on an employer-sponsored plan (including plans that are not HDHPs) is now higher than the minimum allowable deductible for an HDHP ($1,669 versus $1,400).

And in the individual market, for people who buy their own health insurance, average deductibles are even higher: For people who buy their own coverage outside the exchange, average deductibles exceed $4,000 for a single individual. Cost-sharing reductions (CSR) result in lower deductibles for about half of the people who buy their plans in the exchange. But average deductibles in the exchange are substantial for people who aren't CSR-eligible.

In most cases—for employer-sponsored plans as well as individual market plans—HDHPs tend to have deductibles that are higher than the minimums allowed by the IRS. but it's clear that the average deductibles across all plans are now well within the range of "high deductible" when it comes to the specific HDHP requirements.

So while the concept of a high deductible can seem scary, these plans are certainly well worth considering if you have one as an option, especially if you have the means to contribute to an HSA and reap the tax advantages that go along with that. The deductible might not be as high as you're expecting, and as we'll discuss in a moment, the out-of-pocket maximum on an HDHP might be lower than the out-of-pocket maximum on the other plans available to you.

Lower Out-of-Pocket Maximums With HDHPs

When HDHPs debuted in 2004, the IRS limited their maximum out-of-pocket exposure to $5,000 for a single individual and $10,000 for a family. These limits are indexed for inflation each year. Over the course of 17 years, they've increased by more than 40%, to $7,050 and $14,100, respectively, as of 2022.

Back in 2004, there weren't any limits on how high out-of-pocket maximums could be on other types of health coverage—HDHPs were unique in terms of having a federally-set cap on how high an enrollee's out-of-pocket exposure could be. And while employer-sponsored plans often had quite generous coverage with limited out-of-pocket costs, it wasn't uncommon to see five-figure out-of-pocket limits in the individual market for people who purchased their own health insurance.

But starting in 2014, the Affordable Care Act implemented caps on in-network out-of-pocket costs for all plans that weren't grandmothered or grandfathered. These caps are indexed annually, so the out-of-pocket maximums allowed under the ACA have increased each year.

But the formula that's used to index the general limit for out-of-pocket maximums isn't the same as the formula that's used to index the limit on out-of-pocket maximums for HDHPs. In 2014, the two limits were the same. The cap on out-of-pocket maximums that applied to HDHPs that year was $6,350 for a single individual and $12,700 for a family, and those same limits applied to non-HDHPs as well.

But from 2014 to 2022, the general cap on out-of-pocket costs for non-HDHPs has increased by more than 37%, growing to $8,700 for a single individual and $17,400 for a family. In that same period, the cap on out-of-pocket maximums for HDHPs has increased by just 11%, to $7,050 for a single individual and $14,100 for a family.

As a result, people shopping in the individual market for health insurance will tend to see several non-HDHPs that have higher deductibles and out-of-pocket maximums—and lower premiums—than the available HDHPs.

And people who are enrolling in a health plan from an employer might find that the maximum out-of-pocket exposure on the HDHP option (if one is available) could be lower than the maximum out-of-pocket exposure on the more traditional plan options.

This can be counter-intuitive, as we tend to think of HDHPs as the low-cost, high-deductible option. But the dynamics of the rules for out-of-pocket limits have slowly resulted in HDHPs no longer being the lowest-priced plans in most areas. And although HDHPs do tend to be the lowest-cost plans offered by employers, it's not uncommon to see higher total out-of-pocket costs on the non-HDHP options (in conjunction with pre-deductible coverage for non-preventive care—there's always a trade-off).

HDHP Pre-Deductible Care and Services

Under the terms of the ACA and subsequent federal regulations, all non-grandfathered health plans must fully cover a specific list of preventive care with no cost-sharing for the insured. That means the preventive care has to be covered before the deductible, and no copays or coinsurance can be charged.

But HDHPs were previously not allowed to pay for members' health care until the minimum deductible (ie, at least $1,400 in 2022) had been met. So in 2013, the IRS issued regulatory guidance to clarify that a health plan could comply with the ACA's preventive care rules and still be an HDHP.

As a result, HDHPs cover preventive care in the same manner as other health plans: pre-deductible, and without the member having to pay anything for the service (if services other than the recommended preventive care are performed, the member will have to pay the full cost—at the network negotiated rate—if they haven't yet met the deductible).

The IRS rule that allows HDHPs to provide pre-deductible coverage only applies to preventive care that's mandated by the federal government (although as described below, these rules were relaxed a bit as of 2019, and again as of 2020 to address the COVID pandemic). That can cause a conflict of rules when states go beyond what the federal government requires.

For example, federal rules define all types of female contraception (including tubal ligation) as preventive care, so they're covered in full on non-grandfathered health plans. But the federal rules do not require insurers to cover vasectomies for men. And when some states started to require pre-deductible coverage of male contraception, it appeared that their residents would no longer be able to contribute to HSAs, as their health plans would no longer be considered HDHPs if they complied with the state rules.

To address this, the IRS issued transitional relief in early 2018, allowing HDHPs to provide pre-deductible coverage for male contraception through the end of 2019, without losing HDHP status. That gave the states time to revise their laws to provide exemptions for HDHPs, so that they aren't required to provide any care—other than federally-required preventive services—before the minimum deductible is met.

If you look at state legislation regarding insurance mandates, you'll often see special rules for HDHPs. For example, a law that was enacted in New Jersey in 2020 requires health plans to cap an enrollee's out-of-pocket drug costs at no more than $150/month starting in 2021 ($250/month in the case of bronze or catastrophic plans).

But the bill has an exception for HDHPs, noting that they can continue to require the member to pay the full cost of prescriptions until the federally-established minimum deductible is met. If that exception hadn't been written into the rule, all state-regulated (ie, coverage that's not self-insured) HDHPs in New Jersey would have lost their HDHP status under the terms of this new law. That's because they would have had to start covering a portion of their members' medical costs pre-deductible if and when the member needed an expensive medication.

Although the rules for pre-deductible coverage under HDHPs are fairly strict, the IRS has shown flexibility on this issue. In addition to the transitional relief for male contraceptive coverage, the agency also issued new rules in 2019 that expand the list of services that can be covered as preventive care under an HDHP.

Under the new guidance, an HDHP can provide pre-deductible coverage for several specific treatments when patients have certain specific conditions:

To be clear, HDHPs are not required to cover any of these services pre-deductible, since these are not part of the ACA's preventive care mandate. So HDHPs, as well as non-HDHPs, can still have plan designs that impose cost-sharing, including deductibles, copays, and coinsurance, for any of the services listed above.

But the new IRS guidance gives HDHP insurers some flexibility in terms of being able to provide pre-deductible coverage for some services that can help keep members' chronic conditions under control, and help them stay healthier in the long run.

The IRS also published guidance in 2020 that allows HDHPs to cover COVID-19 testing with no cost-sharing, as well as treatment for COVID-19. The federal government and many state governments require virtually all health insurance plans to pay for the cost of COVID testing without requiring the member to pay copays, deductibles, or coinsurance. But there is no federal requirement (and very few state requirements) for health plans to fully pay for the cost of COVID treatment. Some insurers voluntarily agreed to do so for at least several months in 2020, and if these plans were HDHPs, the IRS guidelines allowed them to maintain their HDHP status while also paying for COVID treatment pre-deductible.

Summary

High-deductible health plans, or HDHPs, are a special type of health plan regulated by the internal revenue service. There are minimum deductible and maximum out-of-pocket rules that HDHPs must follow, and they cannot pay for any non-preventive services before the minimum deductible is met. A person who has HDHP coverage is eligible to make pre-tax contributions to a health savings account.

A Word From Verywell

High-deductible health plans are a special type of health plan that will allow you to contribute pre-tax money to a health savings account. Money in that account can grow over time, as there's no "use it or lose it" rule for HSAs.

And while the term "high-deductible" might seem intimidating, it's important to understand that HDHPs often have deductibles that are very comparable to the deductibles on non-HDHPs. Depending on your specific needs, an HDHP might be a good fit for your health coverage, especially if you're willing and able to make contributions to an HSA.

Was this page helpful?Thanks for your feedback!Sign up for our Health Tip of the Day newsletter, and receive daily tips that will help you live your healthiest life.

You're in!Thank you, {{form.email}}, for signing up.

There was an error. Please try again.

What are your concerns?26 SourcesVerywell Health uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy.